TTY 711 (M-F 9am-5pm)

Not affiliated with or endorsed by the

government of Federal Medicare program.

Not affiliated with or endorsed by the government of Federal Medicare program.

Attend our “Live” Local Medicare Education Workshop

Are You Turning 65?

Or Do You Already Have Medicare?

If you are retired military and have TRICARE for Life, book a call with me to go over your options.

If you are retired military and have TRICARE for Life,

book a call with me to go over options.

A Licensed Insurance Agent

Hi, my name is David R. Kim and I work exclusively with retired military.

The Medicare market can be confusing with many options.

I can help unpack and help you understand your benefits in simple, easy to understand language.

Let me help you maximize your Medicare Advantage benefits utilizing your well deserved TRICARE for Life Benefits with plans that were specifically designed with veterans in mind.

A Licensed Insurance Agent

TRICARE FOR LIFE

Michele Rumph

“Very helpful and knowledgeable.

Went step by step and kept me

informed along the way. Anthony

thank you for your help and

patience.”

Darel Mccorkle

“Tyler helped my out. I would

recommend him to help you out

with your Medicare decision.”

Retired Military members receive TRICARE for Life to pay the medical costs that Medicare doesn’t cover and also provides prescription drug coverage.

All Medicare members who have Part A and and B, can choose to get their Medicare benefits from a private company with a Part C plan, also called Medicare Advantage.

If you have TRICARE for Life, you should only enroll in a Part C plan WITHOUT drug coverage, because you already have great drug coverage. TRICARE for Life stays secondary and still pays your co-pays on a Medicare Part C plan.

Retired military who are turning 65 can enroll in Medicare Part B three months prior to turning 65. Once enrolled, your TRICARE Prime or TRICARE Select will convert to TRICARE for Life.

There is no premium for TRICARE for Life and will work as a secondary insurance that works in conjunction with Medicare or Medicare Advantage and will cover co-pays and prescriptions. Dependents who have CHAMPVA are also available for the same Medicare Advantage programs available to TRICARE for Life recipients.

For more information on how TRICARE for Life works with Medicare Advantage plans, please visit:

https://tricare.mil/FAQs/TRICARE-with-Medicare/TRIMed_Advantage

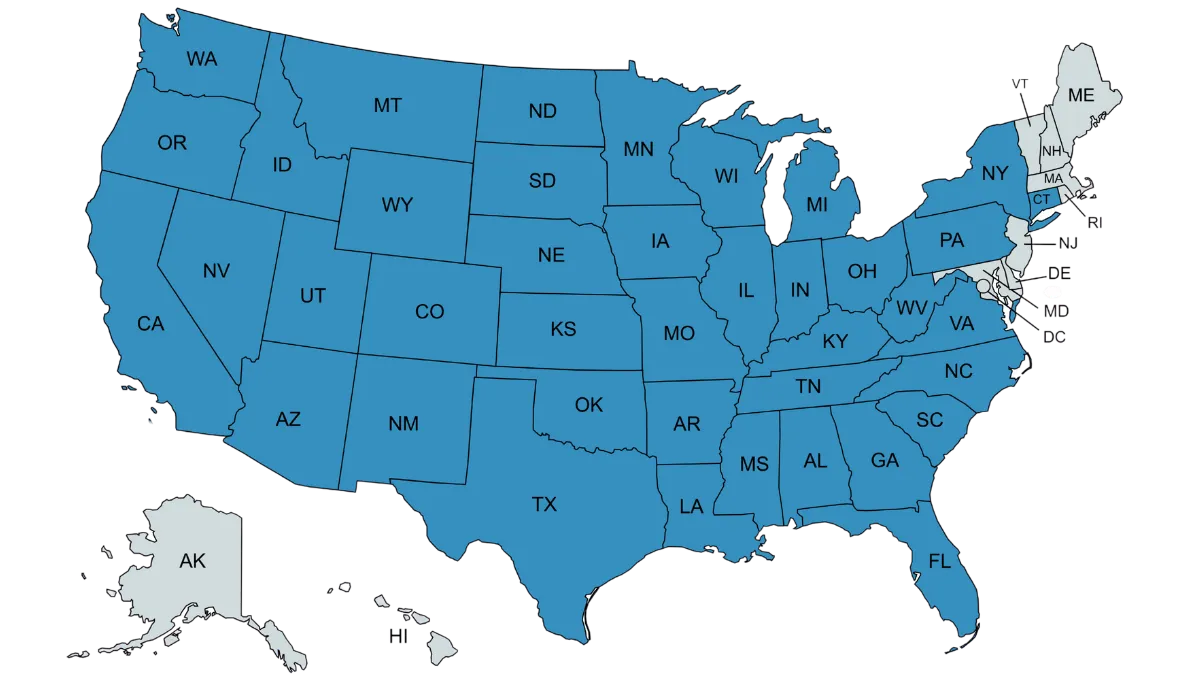

I'm Licensed in the Following States:

More About Myself

A few years ago, I ended up having open heart surgery which led to six heart bypasses. I was then diagnosed with Congestive Heart Failure, so I completely understand the importance of having good healthcare coverage and knowing what is available to you.

I find great satisfaction in helping the retired military community.

TRICARE for Life is an incredible program reserved only for those who have served our country through the military for at least twenty years. This is a benefit that is well deserved, and you’ve earned it. The programs I work with work in conjunction with TRICARE for life as not to affect your TRICARE for Life benefits.

I’ve been in the Finance and Insurance industry since graduating college in 1990. It is very satisfying when I am able to use my experience to help people.

Today, I only focus on helping retired military with Medicare Advantage. Having narrowed my field of services allows me to better service my clients.

FAQ'S

Will I lose TriCare for Life benefits?

No. TriCare for Life will work as a secondary insurance or supplemental insurance to Medicare Advantage.

Who covers the cost of my prescriptions and where can I pick them up?

TriCare for Life still covers your prescriptions. Have them filled just as before. There are no changes.

Am I still paying Medicare Part B premium?

Yes, you are still paying your Medicare Part B premium. Depending on the plan you choose, a portion of your Part B premium will be paid for by the plan.

Will I have co-pays?

No, TriCare for Life will continue to cover your co-pays.

Which card do I present to my doctors and hospitals?

You will provide your new Medicare Advantage card which is your primary insurance and also provide your military ID so they are aware you have TriCare for Life as your secondary.

Can I see the same doctors I currently see?

Yes in most cases. The majority of doctors who accept Original Medicare also accept Medicare Advantage.

It is best to use doctors within the providers network for simplified billing however if you do run into a situation where your existing doctor does not accept Medicare Advantage and is willing to bill out of network, you can still continue to use the same doctor.

Do I need a referral to see a specialist?

The plans I work with are PPO programs so you will not need referrals to see a specialist. It is best to see a specialist within network for simplified billing.

Can I go back to original Medicare? Or Change my plan?

Yes. During the Annual Enrollment each year, you can always switch back to original Medicare. You can change between Medicare Advantage plans during the Annual Enrollment and Open Enrollment periods.

When can I enroll in Medicare Advantage?

You can enroll in a Medicare Advantage program once you have Medicare Parts A & B. You can enroll in Medicare three months prior to turning age 65 and up to three months after turning age 65. You may also be eligible for Medicare and TriCare for Life earlier than age 65 if you are disabled through the military.

Blog

No blogs found

Veterans Healthcare Agent's are not affiliated with any government agencies.

Disclaimer: Not affiliated with or endorsed by the government of Federal Medicare program. Medicare has neither reviewed nor endorsed this information. For accommodations of persons with special needs at meetings, please call (213) 999-1174 a licensed insurance agent TTY 711 (M-F 9am-5pm). By calling this number you will be directed to a licensed insurance agent. Not affiliated with or endorsed by the government of Federal Medicare program.